By Daniel Brettler, Michele Fields, Nathalie Smyth, Sarah-Jane Dobson, Mert Guler, and Jeff Owen-Hicks

MENTAL HEALTH CRISIS

Recent statistics from the World Health Organization suggest that the COVID-19 pandemic triggered a 25% increase in the prevalence of anxiety and depression worldwide. This exemplifies a substantial warning that all countries need to vastly improve their mental health services, treatment and support.

More than 320 million people globally suffer from major depressive disorder (MDD), making it one of the leading causes of disability worldwide. With this and other mental illnesses including substance addictions becoming increasingly widespread, the cost has never been higher. In the UK alone, poor mental health is reported to cost the economy over £100bn per year in lost productivity, excluding treatment expenses incurred by healthcare providers and the physical and emotional cost to the sufferers themselves. In recognition of the wider impact of poor mental health, the UK government is publishing a draft Mental Health Bill to modernize the Mental Health Act. It is also investing £122m to roll out a vital NHS England service, providing those who receive mental health support with employment advice to help them stay in work or return to the job market more quickly. The promotion of good mental health and wellbeing should be high on the agenda for businesses, health providers and their insurers.

While treatments do exist, finding an alternative long-term solution is big business, particularly where existing psychotherapeutic or psychopharmacological treatments or therapies are not working, for example, for those suffering from treatment-resistant depression.

Many stakeholders in the life sciences industry believe that psychedelics could be the solution.

PSYCHEDELICS — WHAT ARE THEY?

Psychedelics, also known as hallucinogens, are a class of psychoactive substances that produce changes in perception, mood and cognitive processes. Many occur naturally in trees, fungi, seeds and leaves, while others are made synthetically in laboratories. Examples include LSD1, Psilocybin2, DMT3, MDMA4 and Ketamine5.

Their use as a medical treatment for mental health issues has lain dormant for decades due to prohibitions based on their classification as illicit substances and stigma. However, with legal restrictions easing and attitudes changing, the interest of the biopharmaceutical industry in their potential has reignited. Clinical investigations are increasingly being allowed to take place on their use for the potential treatment of addiction, depression, anxiety, anorexia, post-traumatic stress disorder (PTSD) and even migraines and autism.

Ketamine is the first psychedelic to be approved as a medical treatment of mental health conditions. It faced fewer legal restrictions and regulatory hurdles than other types of psychedelics as it had already been authorized and available as an anesthetic medicine. Against this background, a Ketamine-derived treatment has already been approved for use by the FDA for treatment-resistant depression. Some psychiatrists and treatment centers also offer its off-label use.

Many other promising treatments are in the pipeline.

CLINICAL TRIALS RESEARCH

While pre-clinical research and clinical trials on many psychedelic drugs are still at an early stage, the initial results announced by various biopharmaceutical companies are promising:

• In August 2022, the JAMA Psychiatry Journal published the results of a double-blind randomized clinical trial6 conducted on 93 patients with alcohol use disorder (AUD) all receiving psychotherapy. It concluded that the percentage of heavy drinking days during 32 weeks of follow-up was significantly lower in the groups who received psilocybin (9.7%) than in the group who received an active placebo (23.6%).

• In May 2022, Compass Pathways Plc presented positive data from a large randomized, controlled double-blind Phase IIb study of its COMP360 psilocybin therapy with 233 patients showing that a single 25mg dose, in combination with psychological support, showed a “highly statistically significant reduction in depressive symptoms” after three weeks (p<0.001)7, with a rapid and durable response for up to 12 weeks. This study was published in The New England Journal of Medicine on November 3, 2022, confirming that 29.1% of participants were in remission by week three8.

• In May 2021, a landmark study by researchers at Imperial College London’s Centre for Psychedelic Research directly compared the antidepressant effects of psilocybin and a selective serotonin reuptake inhibitor (SSRI) antidepressant. The data demonstrates that psilocybin could match the antidepressant effects of the SSRI and suggested that it may produce a deeper and faster effect. Since the trial involved only 59 people, much larger and longer trials are required.

• In May 2021, the Multidisciplinary Association for Psychedelic Studies (MAPS) released the results of its phase 3 clinical trial of MDMA-assisted therapy for patients with severe, chronic PTSD. MDMA was paired with rounds of psychotherapy. After three sessions, 32% of users given a placebo no longer qualified for a PTSD diagnosis. But for those given MDMA as well, that percentage was 67%. MAPS is currently sponsoring the second of two Phase 3 trials to support FDA approval of MDMA.

• In February 2021, a Phase IIa study of MDMA for AUD, again carried out by Imperial College London9, proved safety and high efficacy in a small group of patients, with 75% showing continued improvement nine months later, compared to just 21% in a control group receiving standard addiction treatment. Awakn Life Sciences has acquired the rights to that research data and are progressing into Phase IIb.

The investment into psychedelic research shows no signs of slowing down, with further studies being carried out globally by numerous biomedical companies, including Cybin Inc.’s Phase I study into its proprietary DNT molecule (CYB004) for the potential treatment of anxiety disorders.

LEGAL RESTRICTIONS ON USE OF PSYCHEDELICS AS ILLICIT SUBSTANCES

Legal access to psychedelics for therapeutic purposes is limited, largely because their use remains heavily restricted or in some instances prohibited based on their classification under illicit drug regimes, though there are some exceptions, such as psilocybin’s (often in the form of ‘magic mushrooms’) classification outside the prohibited drugs regime in Jamaica, Portugal, the Netherlands and in some U.S. and Canadian states.

Clinical research has also been impeded by the costs and long delays imposed by such regulations outside the illicit drugs regimes. Stakeholders in the industry, including leading psychiatrists, have been calling for their re-classification outside the illicit drugs regimes so that research may be conducted more easily and that certain psychedelics may be legally prescribed and supplied by pharmacists and doctors in limited settings.

It seems that governments worldwide are starting to take notice.

IN THE UK

The use and possession of most psychedelics in the UK (including psilocybin, MDMA, LSD and DMT) is restricted based on its current classification as a Schedule 1 substance. These are substances that are defined as illicit drugs under the Misuse of Drugs Regulations 2001, with the exception of Ketamine which is Schedule 2. Schedule 1 is the most tightly controlled class of drug in the UK, other examples being some fentanyl opioids and crack cocaine, and cannot be lawfully possessed or therefore used (including as legitimate medical treatment via prescription) in the UK without a Home Office personal license, which is a license granted to an individual to be carried on a person without risk of prosecution for a drug offence under the Misuse of Drugs Act 1971.

A Home Office “controlled drug licence” (domestic) is generally required for the production, possession, or supply of controlled drugs and a register is used to record details of any such drugs received or supplied by a pharmacy. While the Schedule 1 classification does not prevent research or clinical trials, it does make legitimate scientific and medical research difficult to conduct due to costs and time frame restrictions.

Nevertheless, attitudes are changing towards psychedelics and support is growing for their reclassification:

• The Conservative Drug Policy Reform Group (CDPRG), whose members include Conservative MP Crispin Blunt, is campaigning to have psilocybin reclassified as a Schedule 2 drug so that it can be easier, cheaper and quicker to facilitate clinical trials. This means that it would fall into the same category as medicinal marijuana, which became permissible to prescribe due to a reclassification under the controlled drugs regime in 2018.

• In May 202110, a poll carried out on 1,763 members of the UK general public found that 55% would support relaxing research restrictions on psilocybin and 59% would consider psilocybin-assisted therapy if offered to them.

• In 2021, the then Prime Minister Boris Johnson indicated that the government was working with the Advisory Council on the Misuse of Drugs to consider whether barriers to legitimate research on controlled drugs, including psilocybin, could be removed.

Notwithstanding these developments, progress has been slow.

IN THE U.S.

In the U.S., most major psychedelic drugs, with the exception of Ketamine, are unable to lawfully be used based on their classification as ‘Schedule 1’ substances under the Controlled Substances Act of 197011. This is the federal U.S. drug policy that provides the regulation of the manufacturing, importation, possession, use and distribution of drugs deemed to have no medical value or a high potential for abuse.

However, the legal landscape is changing, with many psychedelic treatments currently undergoing clinical trials and advancing through the U.S. Food and Drug Administration (FDA) review and approval process, e.g. for the use of MDMA and psilocybin in psychedelic-assisted psychotherapy. It is expected that many of these will be approved for the treatment of various psychiatric illnesses over the next few years.

More recently, on July 13, 2022, two amendments were passed in the U.S. House of Representatives allowing the provision of psychedelic-assisted treatment to veterans and active duty service personnel who suffer from PTSD.

Various U.S. jurisdictions also passed laws, at state and local levels, to reduce criminal penalties relating to their use:

• In November 2020, Oregon was the first state to legalize psilocybin. Starting on January 1, 2023, psychotherapists in Oregon will be allowed to treat their patients with psilocybin.

• A number of U.S. cities, including Denver and Detroit, have eliminated or restricted criminal penalties for the use and possession of some psychedelics.

CANADA

Most psychedelics, including psilocybin and LSD, are impermissible to use legally based on their categorization as Schedule III controlled substances under Canada’s Controlled Drugs and Substances Act (CDSA), though MDMA and ketamine are listed under Schedule I12.

All of these substances are generally prohibited unless used by an authorized person or an exemption is granted in limited circumstances. For example, a qualified investigator may possess a restricted drug for the purpose of conducting clinical testing or laboratory research in an institution, or the Minister of Health may grant an exemption if the substance is necessary for a medical or scientific purpose or is otherwise in the public interest13.

However, in January 2022, Health Canada14 amended its rules15 to allow practitioners to request limited patient access to certain psychedelic drugs for any serious, life-threatening or treatment-resistant condition. More recently in October 2022 it was announced that Alberta will be the first Canadian province to allow the use of psychedelic drugs solely for therapeutic use. Under the plan, Psilocybin, MDMA, LSD and Ketamine amongst others will be used as a treatment for psychiatric disorders.

Prior to this, the government had granted only very limited access to psychedelics for illnesses such as late-stage cancer. For example, in August 2020 an exemption was granted for use of psilocybin to assist with anxiety and depression in four Canadian patients receiving end-of-life treatment.

This recent shift, which may have been prompted by the legalization of cannabis in 2018, is perhaps a signal that the government acknowledges the therapeutic benefits of some psychedelics.

We continue to keep a close eye on developments.

POTENTIAL LIABILITIES

As with any new product, it is important to assess the potential liabilities arising from the use of psychedelic drugs so that these can be minimized and the necessary precautions taken.

Professor David Nutt, Edmond J. Safra Professor of Neuropsychopharmacology and director of the Neuropsychopharmacology Unit in the Division of Brain Sciences at Imperial College London has stated to us that “the treatment model is very different from traditional mental illness treatments in that the drugs are given just once or twice rather than daily for months or years. This massively reduces patient exposure to the medicine and is likely to reduce adverse effects.”

With this in mind, we set out our thoughts on liability below:

Clinical trials: The usual risks arising in the context of clinical trials will apply equally to psychedelics, such as the potential for adverse effects and failure to adequately treat or report those effects. Batches should be manufactured in an appropriately controlled environment and doses should be administered (and effects monitored and treated) by adequately trained and qualified medical staff.

Capacity to consent: While all drug recipients should go through an informed consent process, special care should be taken with those who may suffer from more severe mental conditions, for example, suicidal tendencies, psychosis or delusions, to ensure that they have sufficient capacity to understand and agree to the administration of psychedelic treatments, whether during clinical trials or otherwise.

Appropriate treatment settings: Given their hallucinogenic properties, the administration of psychedelics in an appropriate setting is important to support a positive experience. Patients may be exposed to greater risks of harm or an exacerbation of symptoms if used in unregulated settings without the supervision of trained practitioners and appropriate preparatory therapy sessions. Failure to identify pre-existing mental health conditions and acute risks such as suicidality and psychosis may also place patients at higher risk of harm. Should a patient then be injured in such circumstances, the supplier or prescriber of the treatment may be at risk of a claim.

Warnings: It is important that users are fully informed about their use in order to minimize the risk of injury. Instructions for Use (IFU) should clearly set out warnings about (i) potential adverse reactions, side effects, risks and contraindications, (ii) appropriate usage and dosages, (iii) the environment in which drugs are to be administered and by whom and (iv) procedures for before, during and after administration of the medicine (i.e. observation of the patient for several hours after administration etc).

Post-market surveillance: As the long-term effects of psychedelics are relatively unknown, post-market surveillance will be essential to identify any unexpected adverse effects or unexpectedly high rates of certain effects.

Controlled use: In the event that psychedelics are rescheduled, drug agencies and industry stakeholders will likely be keen to ensure that appropriate restrictions apply to their sale, distribution, provision and use, in order to restrict potential misuse. It is likely that only medical practitioners and other properly licensed persons and entities (with appropriate insurance in place) will be authorized to supply, prescribe and administer them in the short-term.

Potential for wider distribution: There is the potential for psychedelics to be made more widely available should the medium to long term results prove favorable and there is an appetite for this treatment as a solution to the growing mental health crisis. As with any product that is widely distributed, this increases the potential for more product and personal injury claims against manufacturers, importers, prescribers and medical professionals and other stakeholders.

Appropriate insurance coverage should be acquired for all these circumstances.

INSURANCE CONSIDERATIONS

The market for insuring life science products is currently robust, with many insurance companies competing for opportunities. Identifying the right type of coverage for pharmaceutical products can present some challenges, typically characterized by the varying levels of liability limits, scope of coverage, deductibles and premiums available from insurers. The appetite for certain kinds of product exposure will also vary between insurers, which certainly appears to be the case for psychedelic products.

The most common insurance policy addressing the potential liabilities arising from product use is product liability insurance. This is widely available from the insurance market for exposure to patient injury arising from clinical trials and commercial product sales. Not all product liability policies are alike with each having nuanced language that may work for or against the policyholder, for example, exclusions for the U.S. Drug Enforcement Administration16 Schedule 1 products, under which some psychedelics may fall. Despite this, some insurers have already been gravitating towards underwriting psychedelic products, though this is very much an emerging market.

Many companies in the psychedelics space are start-ups focused on attracting high quality board members, resulting in a strong need for directors and officers (D&O) liability insurance. Until 2020, the D&O insurance market had little interest in these companies, which resulted in low coverage capacity, high retentions and extremely high premiums. However, over the past 18 months, insurers have gained a better understanding of the associated risks and have since been attracted to the space, as demonstrated by an increase in coverage capacity, and reduced retentions and premiums by up to 50% and 45% respectively.

FUTURE

Larger scale and longer term trials are required to further investigate the safety and efficacy of psychedelic treatments. However, given their preliminary promise, many are hopeful that they may be the solution to the burgeoning mental health crisis, which is costing the global economy and health insurance industry billions every year. We will very much be staying tuned in.

REFERENCES

1 LSD (or Lysergic acid diethylamide) is entirely synthetically made and was first produced in 1938. It was studied in the 1950s and 1960s, but was banned in the U.S. in the late 1960s despite some promising initial research. It is still classified as a Schedule I drug by the FDA.

2 Psilocybin is a naturally occurring substance produced by over 200 species of mushroom. It has been decriminalized in several U.S. cities, including Denver, over the last few years.

3 DMT (or Diemethyltryptamine) can be synthesized in a laboratory or found in plants. It has been used in psychedelic rituals and practices across South and Central America for many centuries.

4 MDMA (or 3,4- Methylenedioxymethamphetamine) is a synthesized drug and was first produced in 1912. While it is not a classic psychedelic (as it does not produce traditional hallucinatory effects) it is known to induce euphoria and increased sociability. The drug known as ‘ecstasy’ is MDMA cut with other compounds.

5 Ketamine was first synthesized in 1962 and is primarily an anesthetic (and so legally available), though can produce psychedelic effects. It was the first psychedelic to be approved for the treatment of mental health conditions. The ketamine-derived nasal spray Spravato, sold by

Janssen Pharmaceuticals, Inc, was licensed for treatment-resistant depression by the FDA in 2019.

6 The study (whose lead author is Michael P Bogenschutz) was conducted at the NYU Grossman School of medicine and the University of new Mexico Health Sciences Centre.

7 P<0.001 is less than 1 in 1000 chance of the results being wrong

8 https://compasspathways.com/compass-pathways-announces-publication-of-phase-2b-study-of-comp360-psilocybin-therapy-for�treatment-resistant-depression-in-the-new-england-journal-of-medicine/

9 BIMA (Bristol Imperial MDMA in Alcoholism Study)

10 Psilo Nautica & Drug Science Paper on ‘Public Attitudes to Psilocybin-Assisted Therapy’

11 Title II of the Comprehensive Drug Abuse Prevention and Control Act of 1970

12 Schedule 1 substances are deemed to have the highest potential for abuse and impose higher penalties, followed by Schedule 2 and so on.

13 Under Section 56 of the CDSA

14 The department of the Canadian Government responsible for national health policy

15 The Food and Drug Regulations and the Narcotic Control Regulations

16 Drug Enforcement Administration

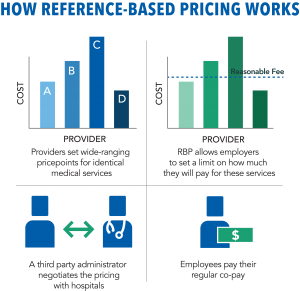

meters on how much a plan will pay for medical services that tend to widely vary in price. These plans set a “reasonable fee” for certain services, which is frequently calculated based on Medicare pricing and general cost information. Considering the rising healthcare costs in the U.S., this strategy gives employers and employees more control over healthcare costs.

meters on how much a plan will pay for medical services that tend to widely vary in price. These plans set a “reasonable fee” for certain services, which is frequently calculated based on Medicare pricing and general cost information. Considering the rising healthcare costs in the U.S., this strategy gives employers and employees more control over healthcare costs.

TREND: INCLUDING CHANGE MANAGEMENT WITH TECHNOLOGY IMPLEMENTATION

TREND: INCLUDING CHANGE MANAGEMENT WITH TECHNOLOGY IMPLEMENTATION