We are proud to celebrate more than 60 years of success. See a timeline below of important milestones. To view the full version click here.

Morales, Potter & Buckelew, Inc. is founded after Joseph Buckelew purchases the agency, Morales and Potter. Fifty years and many mergers and acquisitions later, the firm name honors Joseph’s involvement from the early days.

Morales, Potter & Buckelew, Inc. agrees to purchase the Toms River Agency on March 1, 1966.

In five years, Morales, Potter & Buckelew, Inc. acquires four agencies: Phyllis Knowles, Beachwood Agency, Griggs Agency, Katherine Bahlburg Agency, Harold J. Fuccile Agency.

George Norcross joins Zinman Grossman Lichtenstein Co.,a Philadelphia-based insurance brokerage founded in 1890, where he began a lifelong business partnership and friendship with Bob Tanke.

The Zinman Group is purchased by E. H. Crump Companies and several years later George Norcross establishes Keystone National.

Morales, Potter & Buckelew, Inc. agrees to merge with the Benjamin Novins Agency on November 2, 1981.

Morales, Potter & Buckelew, Inc. and the Cardamone Agency, agree to merge operations on July 12, 1983.

Keystone National expands its presence by opening an office in Florida. Keystone’s President, Bob Tanke, oversaw the operations of the new office located in “Tanketown, Florida.”

Buckelew & Associates, headed by Joseph Buckelew, and Keystone National, headed by George Norcross, both agree to sell their operations to Commerce Bank. The combined entity becomes Commerce National Insurance Services.

After acquiring Buckelew & Associates and Keystone National, Commerce Bank acquires seven more agencies through 1999: Chesley & Cline, The Morrissey Agency, Associated Insurance Management, Inc., Reinhart & Associates, J.A. Montgomery Insurance, Mullaney Insurance Associates and William Handlan Associates.

Commerce Bancorp’s insurance division went through several name changes throughout the years, from Commerce National Insurance Services, to Commerce Insurance Services, to Commerce Banc Insurance Services.

Commerce acquires nine more agencies: Traber & Vreeland, Inc., Maywood Agency, Fitzsimmons Insurance & Financial Services, Inc., Business Training Systems, Brettler Financial Group, Sanford & Purvis Insurance, Porch Insurance Agency, Inc., PERMA Risk Management Consulting Services, Consultants for Corporate Benefits, Inc.

The firm welcomes its inaugural internship class to provide students with hands-on experience that prepares them for a future career in the insurance industry.

Commerce Insurance Services hires Michael Tiagwad as its new President.

When TD Bank purchases Commerce, George Norcross and Mike Tiagwad agree to purchase Commerce Banc Insurance Services. The new company is named Commerce Insurance Services.

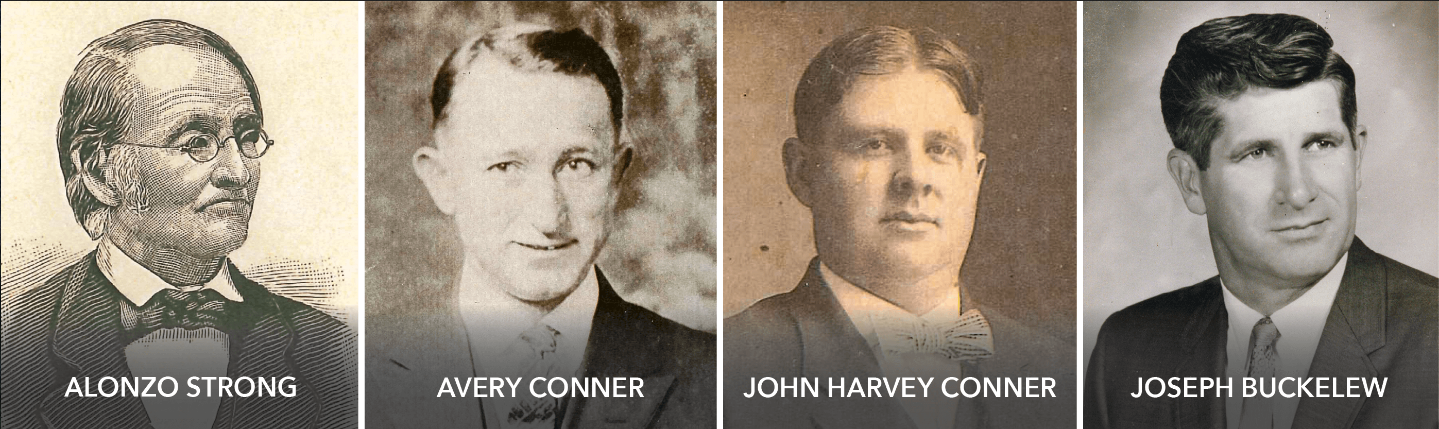

Commerce Insurance Services is rebranded as Conner Strong Companies on July 21, 2008. The names Conner and Strong trace back to the ancestors of George and Sandy Norcross.

Conner Strong opens a new corporate headquarters in Marlton, New Jersey, on June 1, 2009.

Conner Strong formally launches three affiliate companies – PERMA, J.A. Montgomery and AIM – designed to broaden the scope of services available to clients. This new structure allowed Conner Strong & Buckelew and its affiliates to concentrate on their respective core competencies, while delivering best-in-class results for all clients.

The firm adds “Buckelew” to its name and logo. The new name honors the lasting commitment of Mr. Joseph Buckelew, a man known for impeccable integrity, who has had a distinguished career and made significant contributions to the industry and firm.

The firm moves into new offices in Two Liberty Place, a preeminent building in Philadelphia. The new office, which features 25,000 square-feet of world-class space, becomes the firm’s dual headquarters along with the office in Marlton. The firm also launches Conner Strong Captive Strategies as an independent affiliate of Conner Strong & Buckelew. The new affiliate was created to offer alternative risk solutions beyond the traditional insurance marketplace to clients with complex insurance needs.

The firm holds its inaugural Community Day on June 7, 2013. Employees participated in 11 events serving those in need throughout New Jersey and the Philadelphia region.

The firm opens office in New York City, headed by the former risk manager of the City of New York, focusing its efforts on the construction and real estate development sectors.

The firm opens its first office in Boston and seventh office overall. The new location focuses on serving the growing life sciences and construction markets within the Boston region.

The New York operations moved to a new space in the heart of the financial district in Lower Manhattan. The move came as a result of the tremendous recent growth experienced throughout the region.

Conner Strong & Buckelew acquires Capital Management Enterprises.