Reference-based pricing (RBP) is rising in popularity among self-funded employers as a way to curb constantly rising healthcare costs. But it can be difficult for some organizations to know if this form of self-funded employer health insurance is right for them.

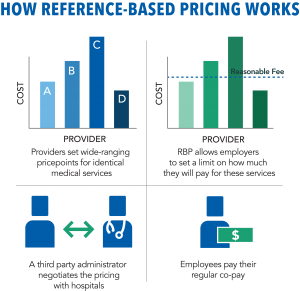

Reference-based pricing allows employers to set para meters on how much a plan will pay for medical services that tend to widely vary in price. These plans set a “reasonable fee” for certain services, which is frequently calculated based on Medicare pricing and general cost information. Considering the rising healthcare costs in the U.S., this strategy gives employers and employees more control over healthcare costs.

meters on how much a plan will pay for medical services that tend to widely vary in price. These plans set a “reasonable fee” for certain services, which is frequently calculated based on Medicare pricing and general cost information. Considering the rising healthcare costs in the U.S., this strategy gives employers and employees more control over healthcare costs.

Healthcare services are unique from other goods and services because their prices can vary greatly based on location and between healthcare providers in the same geographic region. This is true even when the quality of care is virtually identical. It is not uncommon in some geographic locations for the highest cost of a procedure, like a CT scan, to cost well more than 10 times that of the same procedure at a different but similar medical provider. Reference-based pricing helps employers and employees circumvent these discrepancies and acts as a regulating force on providers.

Once implemented, these healthcare plans offer a wide range of benefits. When executed properly, reference-based pricing can cut employers’ healthcare costs by between 20% and 30%. For employees, it eliminates insurance networks and allows them to receive care wherever they choose, provides cost transparency and certainty, and encourages the proactive management of care. Aside from the significant cost savings, reference-based pricing allows employers to maintain consistent quality of care at more predictable costs.

However, implementing reference-based pricing does not make sense for every employer. For some plan sponsors, it is not cost-effective, and others may not be ready to make the organizational changes necessary for implementation.

If your organization answers yes to several of these questions below, reference-based pricing may make sense for your company:

1. Is your health plan self-funded? Reference-based pricing is best suited for self-funded plans.

2. Is your organization fed up with the healthcare insurance status quo and willing to try something different? Reference-based pricing is one way out of relying on your TPA to negotiate discounts on inflated provider charges. If your current benefits plan isn’t quite cutting it, reference-based pricing might be for you.

3. Is your organization willing to leave its current health plan carrier? Plan sponsors may need to leave their current carrier in order to reap the cost-saving benefits of reference-based pricing.

4. Does your organization have the ability to effectively communicate with plan members directly about the need for change in healthcare delivery and engagement? Your employees likely haven’t heard of reference-based pricing and will need a clear, concise explanation of how it works and how it will benefit them.

5. Does your organization have an appetite for a longer transition? This form of self-funded insurance won’t be implemented overnight. Plan sponsors considering it must understand that it may take some time before cost savings are achieved.

6. Is your organization willing to work with a third-party administrator (TPA)? To effectively implement a reference-based pricing strategy, employers must partner with a TPA that has the necessary tools to help manage the plan. TPAs help employers provide member services, have the latest medical pricing data, negotiate with providers on a reasonable fee, and address balance billing issues

Expert counsel to guide your transition

Any plan sponsor making the switch to reference-based pricing should not go at it alone. An experienced benefits advisor that is knowledgeable of your organization’s needs as well as the logistics surrounding a transition to reference-based pricing can help guide you through this process and minimize interruptions.

It is important that plan members experience minimal disruption, and a knowledgeable broker can anticipate any speed bumps and navigate a smooth transition. When executed effectively, switching to reference-based pricing can lead to significant cost savings for your organization for years to come.

Executive Partner, Captive Practice and Creative Solutions Leader

Over 25 years experience in the insurance industry