Employers today have more insurance options than traditional plans – including employee benefit group captives. Group captives allow like-minded employers with 100 to 500 employees to form and manage their own insurance entity. The result is reduced costs and increased control of employee benefits.

Conner Strong & Buckelew partners with Pareto Captive Services to offer unique access to this innovative and contemporary benefits stop-loss captive solution.

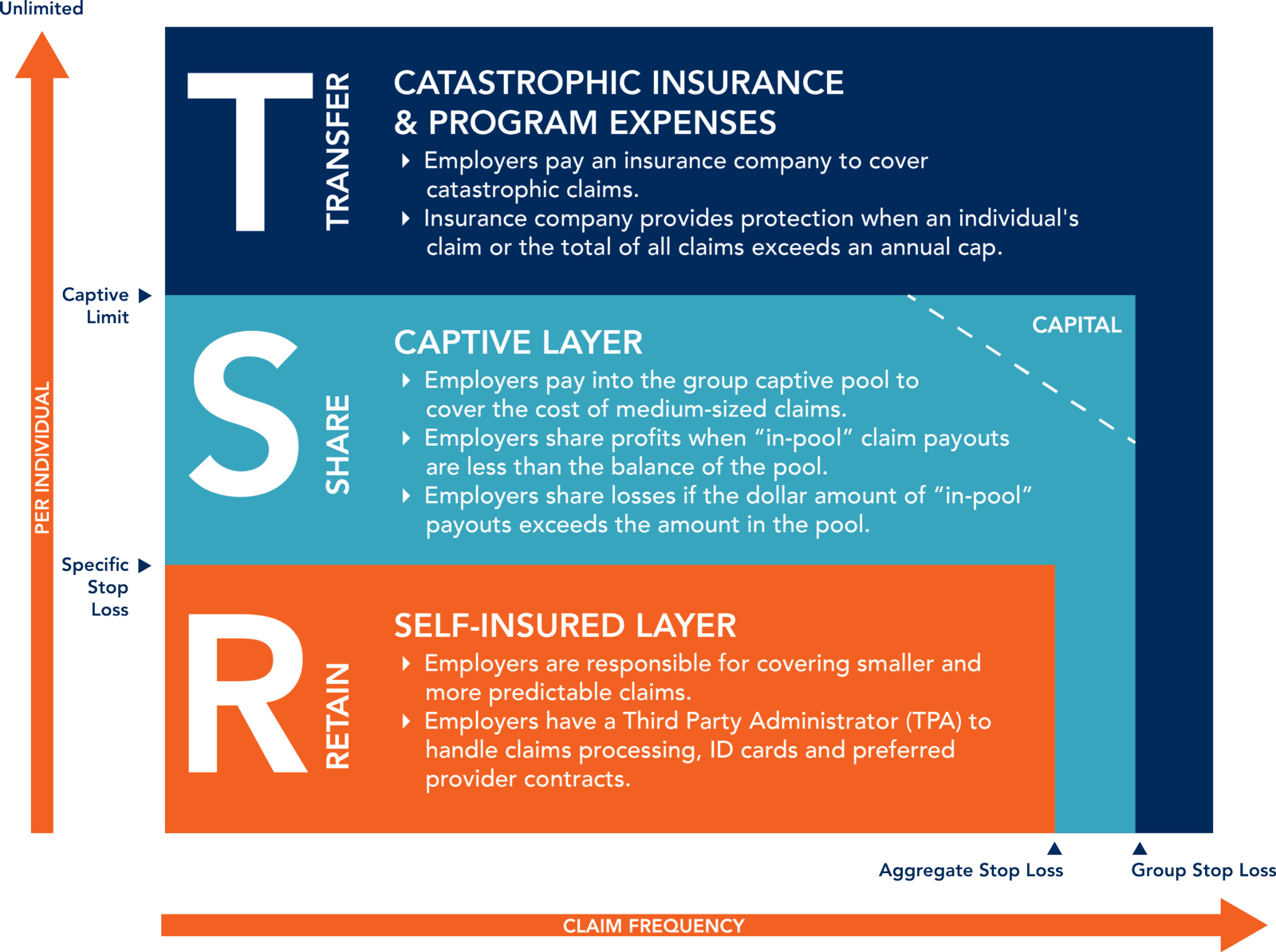

How Employee Benefit Group Captives Work

When employee claims are modest, your organization saves a portion of the profit typically kept by insurance carriers. When claims are extensive, your group captive absorbs the shock. Individual players in the partnership assume the following roles:

Cost Comparison: Group Captive vs. Traditional Insurance

Minimum expenses for claims and overhead could be as low as 15 percent of what you would pay a traditional insurance carrier – in the unlikely scenario of no claims. Conversely, the maximum exposure could be as high as 120 percent of the cost with a traditional carrier. Typically, your exposure will fall in the middle.

Who Benefits From Employee Benefit Group Captives?

The employer. Employee group captives are created by employers, for employers. Your return on investments may include:

This video provides a broad outline of the captive model for preliminary informational purposes.

Vice President, Senior Benefits Sales Leader

Senior Partner, Chief Health Insurance Fund Underwriter & Captive Manager

[email protected]

856-446-9212