As proven industry leaders with a commitment to excellence dating back to 1959, we provide organizations with unmatched insurance brokerage, employee benefits and risk management consulting services.

With a national presence and the industry’s top talent, we have the strength and expertise to consistently deliver outstanding service and results to clients worldwide.

When it comes to your commercial insurance protection, we do more than just finding you competitively priced coverages.

Using our proprietary Return on Risk® model, we take a holistic, consultative approach that also focuses on helping you improve safety and reduce risks that pose a threat to your bottom line. And should a claim occur, we will serve as your advocate to help ensure the best possible outcome.

Risk Retention: We help you identify creative ways to retain risk through the use of deductibles, self-insured retentions and captive insurance programs

Risk Management: We help you minimize risk and maximize recovery through the use of our loss control and claims management resources

Risk Transfer: We help you transfer risk through the procurement of insurance and reviewing contracts with third-party vendors

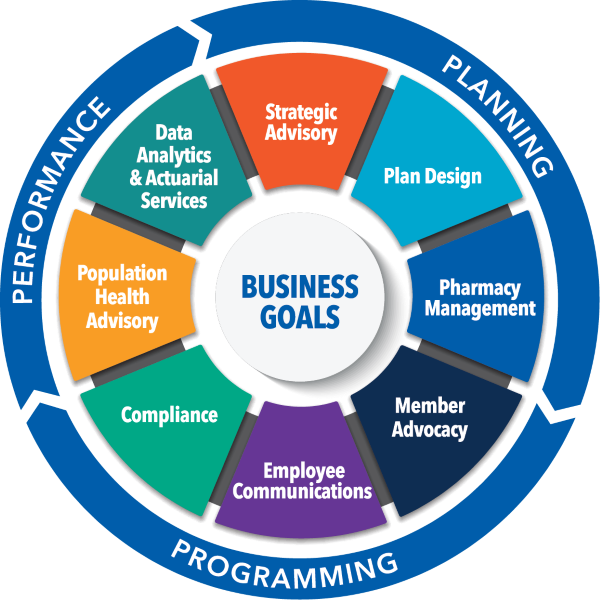

Our dedicated, multi-discipline team provides daily support and partners with you to understand your organization, goals, and employee population. With deep in-house expertise, including an experienced PharmD to help you navigate the complex prescription drug environment, we deliver solutions that can help improve your bottom-line.

Leveraging our proprietary consulting approach, we deliver data-driven advice, cost control, predictability and transparency throughout the benefits cycle.

Delivered to Every Employer, Every Time

Guided by our expert account teams, our proprietary approach combines decades of experience with cutting edge, data-driven insights to develop smart benefits solutions that deliver the highest levels of cost control, predictability, transparency and member value.

35% increase in carrier contributions on casualty claims

39% increase in carrier contributions on property claims

32% reduction in Workers’ Comp experience MODs over a 5-year period

46% reduction in loss rate per $100 of payroll for Workers’ Comp large deductible programs

20% average cost reduction for clients entering pharmacy coalition

40% increase in wellness plan participation

At Conner Strong & Buckelew we believe understanding the industries we serve is paramount to developing innovative, custom solutions. That’s why we’ve built a team that includes individuals who have first-hand experience working in the industries we serve. Plus, our expert staff includes a plethora of highly experienced professionals with advanced degrees, training and licenses in engineering, epidemiology, nursing, occupational safety, law, accounting, environmental remediation, pharmacy and more.

We’re committed to enhancing and advancing the next generation of insurance technology and services. Technology powers the big ideas, actionable solutions, and new ways of working that increase productivity, lower costs and reimagine the insurance experience for companies and clients.